Evaluation Approaches

When dealing with artists who are not yet widely recognized or included among the most prominent names, traditional evaluation methods, such as analyzing auction and gallery sales, are often impractical. In these cases, two primary approaches can be utilized:

- Market Evaluation.

This method is based on data from previous sales at major auctions or galleries. However, for artists not in the top tier, sales statistics are often unavailable, limiting the applicability of this approach. - Parametric Evaluation.

This approach relies on objective criteria, such as the artwork’s genre, execution technique, dimensions, and the artist’s participation in exhibitions or museum collections. This methodology forms the basis of the Art Most online calculator, which assists in determining the value of artworks by emerging or underrated artists.

Practical Recommendations

Evaluating an artwork involves more than assessing its aesthetic or cultural value. It requires considering various objective factors, including:

- The artist’s recognition and reputation.

- Their participation in exhibitions and auctions.

- The inclusion of their works in museums and private collections.

- The genre, size, and technique of the artwork.

For successful investments, it’s essential to follow this rule: the purchase price should be at least 2–3 times lower than the evaluation provided by tools like the Art Most calculator. This strategy reduces risks and increases the potential for long-term profit.

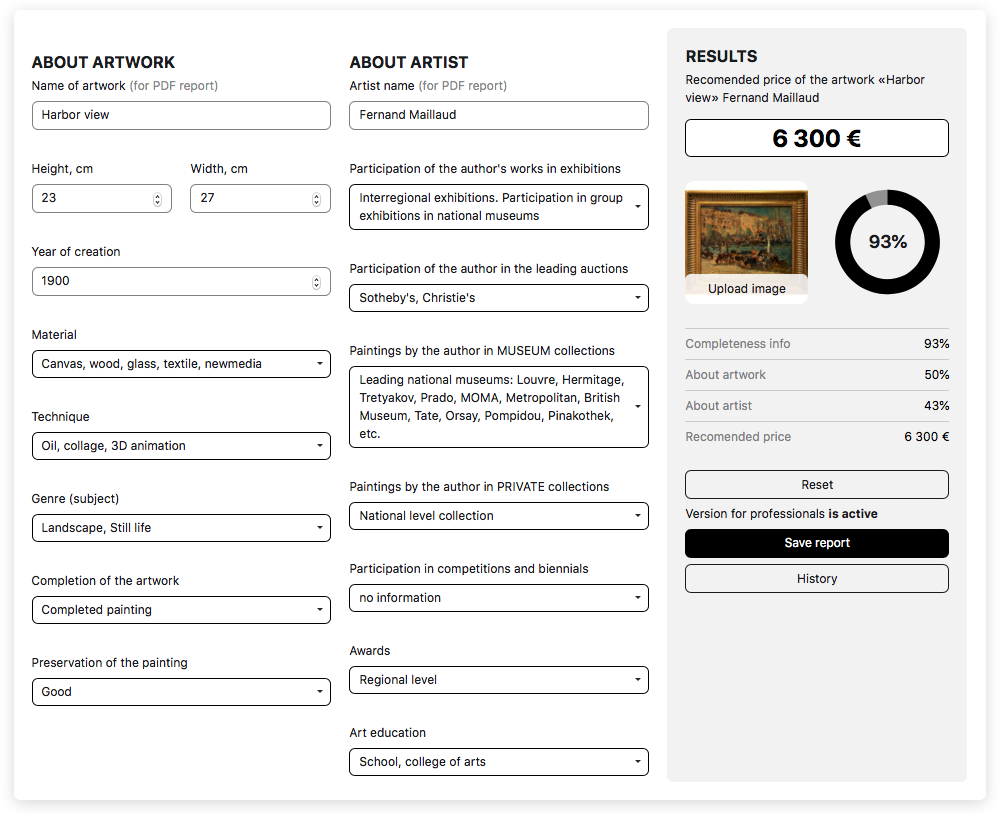

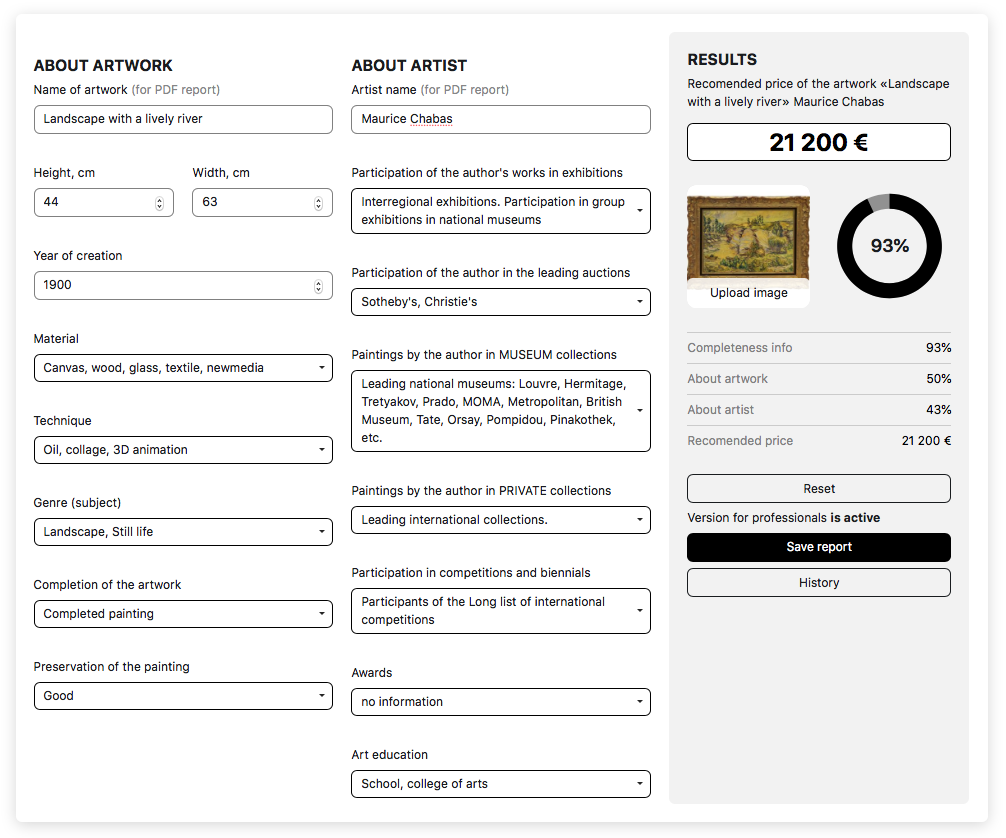

Tool for Analysis: Art Most Art price Calculator

The Art Most online calculator is an invaluable tool for assessing the value of artworks, especially for artists outside the top-tier category.

How it works:

- The calculator considers dozens of parameters, including the artwork’s genre, size, technique, and the artist’s exhibition record.

- It allows you to quickly verify whether the price of an artwork is fair.

- It’s particularly useful when there’s limited public data available about the artist.

Give it a try: Art Most Calculator

“Try to find out the market price of your artwork. Just enter information about the piece and artist achievements and see how the price changes. Now it’s easy and free for you!”

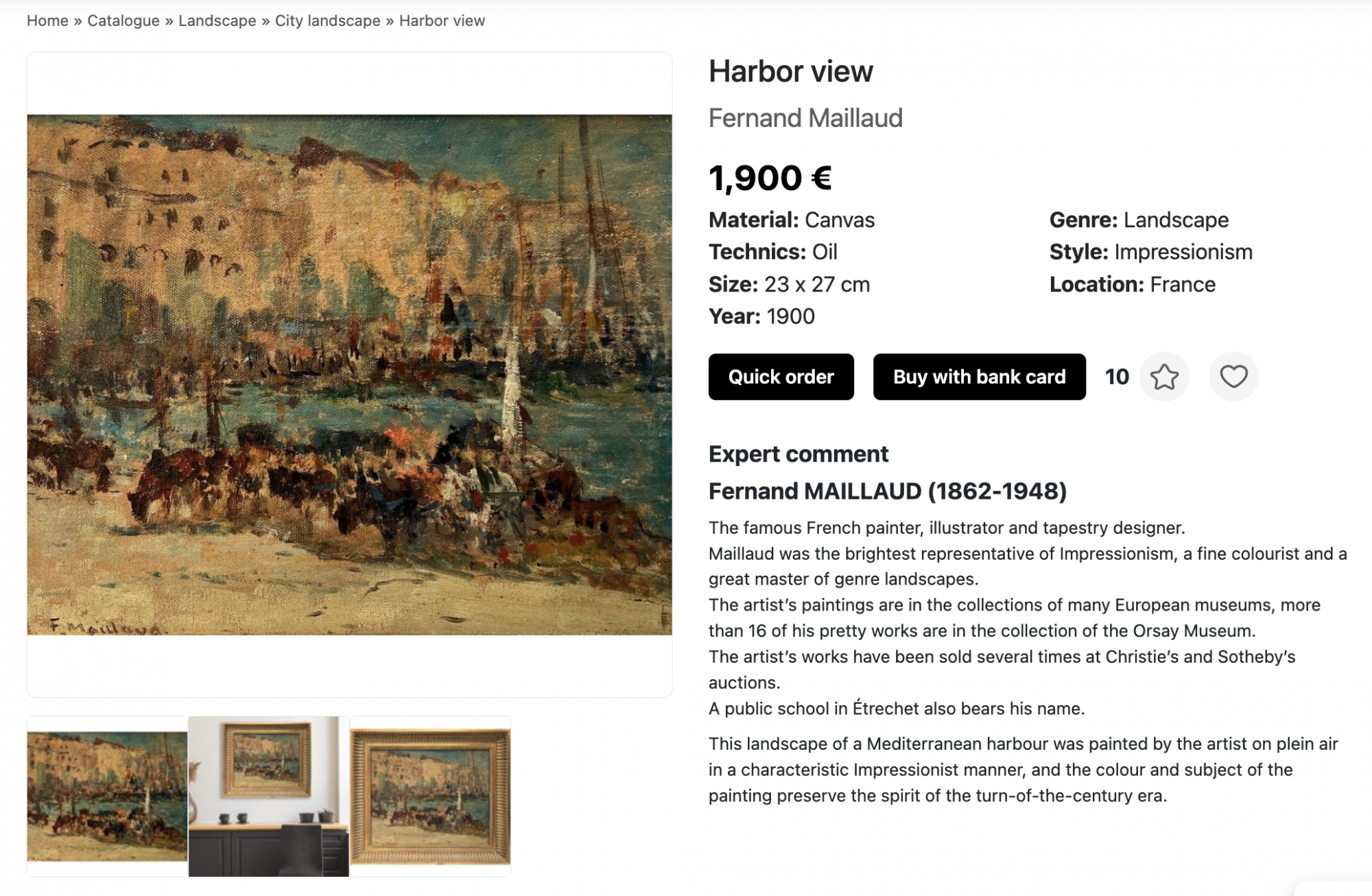

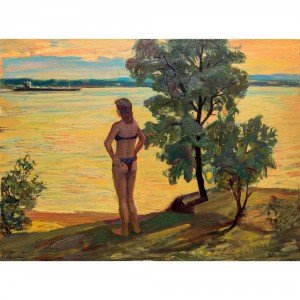

For example, the painting “Harbor View” by Fernand Maillaud is estimated at €6,300 according to the Art Most calculator. However, the artwork is currently listed for purchase at just €1,900 (https://artmost.store/product/harbor-view/) , which is almost 4 times lower than the calculated value. This presents a significant investment opportunity, aligning with the strategy of acquiring artworks well below their estimated market value.

Why Investing in Emerging or Underrated Artists Can Be Profitable

Investing in artworks by emerging or underrated artists can yield significant returns when:

- The artist begins participating in prestigious exhibitions.

- Their works enter prominent private collections or museums.

- Interest in their art increases within the professional community.

Furthermore, there is a noticeable trend of declining availability in the high-value segment of the art market, which makes pieces from second- and third-tier artists more attractive for collectors and investors alike.

Conclusion

Evaluating artworks by artists outside the most prominent names requires a thoughtful approach and the use of available tools. Acquiring artworks at prices 2–3 times lower than their estimated value offers a tangible path to successful investments.

Don’t overlook the potential of these artists; they may very well become the stars of tomorrow.

________________________________________________________________________________________________________________________________

About the Author:

Catherine Borodai is a specialist with a background in investment, art, and marketing. With a keen eye for valuable art investments and extensive experience in strategic marketing, Catherine bridges the gap between finance and creativity. She excels in identifying lucrative investment opportunities in the art world, leveraging her marketing expertise to promote and enhance the value of art assets. Catherine’s unique blend of skills makes her a pivotal figure in the intersecting realms of art investment and marketing strategy.

Connect with Catherine on LinkedIn

Catalogue:

-

Grigoreva-Klimova Olga

Still life with pastries

50 x 60 cm

1,150 € -

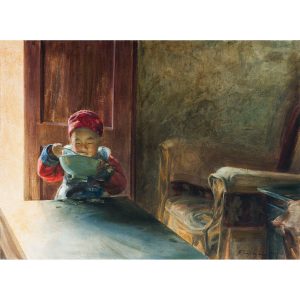

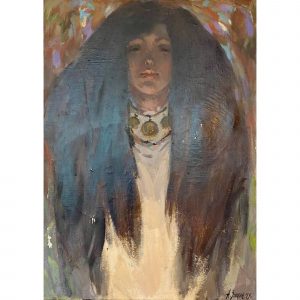

Kharchenko Viktoriya

Heir

100 x 135 cm

5,000 € -

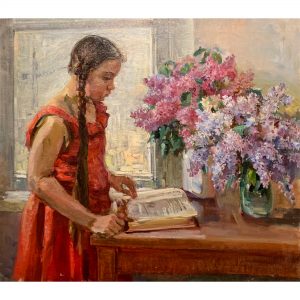

Viktorjevskaya Zinaida

Girl with lilac

80 x 90 cm

2,145 € -

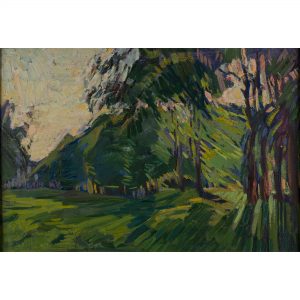

Gilmanov Ildar

Mai. Iremel

60 x 80 cm

500 € -

Tikhomirova Olga

Glimpses

47 x 69 cm

6,300 € -

Zavarin Alexander

Night

70 x 50 cm

9,800 €