Recommended standard for portfolio management

«Investing 5-10% of all assets in the art market»

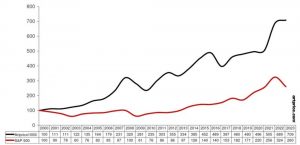

Diagram 1

Art market

«Index Artprice 100»

Diagram 2

1. Mei Moses Art Index

One of the most renowned art market indices is the Mei Moses Art Index, developed by scholars Michael Moses and Jianping Mei. This index analyzes sales data of artworks to help investors understand which segments of the market are in decline or growth. By tracking repeat sales of the same artworks over time, the Mei Moses Art Index provides a reliable measure of market performance, making it a crucial resource for art investors. More information can be found on their official platform: Mei Moses Art Index.

2. AMR Art 100

Another popular index is the AMR Art 100, which monitors art prices at auctions and assists in evaluating the investment potential of artworks. This index includes the top 100 performing artists in the market, offering a focused view on high-value segments. The AMR Art 100 is particularly useful for investors looking to gauge the desirability and price stability of works by leading artists. Detailed information about this index can be accessed on the Art Market Research website: AMR Art 100.

3. The Art Market Review (TAMAR)

The Art Market Review (TAMAR) provides analysis and statistical insights on art prices from various auctions and galleries. It is a comprehensive resource that captures a wide range of data, offering investors a detailed overview of market dynamics. For more detailed information on TAMAR, visit the official site of Art Market Research: Art Market Research.

4. Artnet Fine Art Index

Artnet, a well-known platform in the art world, offers its own Fine Art Index, which tracks price changes in artworks. This index draws from a vast database of auction results and provides a clear picture of price trends over time. Investors can use the Artnet Fine Art Index to compare different periods and understand the market’s historical performance. More information is available on Artnet’s official website: Artnet.

5. FTSE All-World Index

While not a direct art index, the FTSE All-World Index reflects the broader stock market and can be useful for comparing art investments with other financial instruments. By juxtaposing art market trends with this comprehensive stock market index, investors can better understand how their art investments perform relative to traditional assets. More details can be found on the FTSE Russell official site: FTSE Russell.

Conclusion

Art market indices serve as vital tools for analyzing market conditions and making informed investment decisions. However, it is important to remember that these indices are just one aspect of art market analysis. Investors should consider multiple factors influencing art prices, such as historical significance, artist reputation, and current market demand, before making any investment decisions.

Use these indices as a starting point to delve deeper into the art market and stay abreast of changes and trends. For additional details on these indices, follow the provided links and continue exploring the dynamic world of art investment.

Leopold Survage

«Abstraction»

Canvas, oil.

Jean Pougny

«Abstraction»

Canvas, oil.

About the author:

Catherine Borodai is a seasoned specialist with a robust background in investment, art, and marketing. With a keen eye for valuable art investments and extensive experience in strategic marketing, Catherine bridges the gap between finance and creativity. She excels in identifying lucrative investment opportunities in the art world, leveraging her marketing expertise to promote and enhance the value of art assets. Catherine’s unique blend of skills makes her a pivotal figure in the intersecting realms of art investment and marketing strategy.

CATALOGUE:

-

Kollman Karl

Three Peasants

16 x 23 cm

3,300 € -

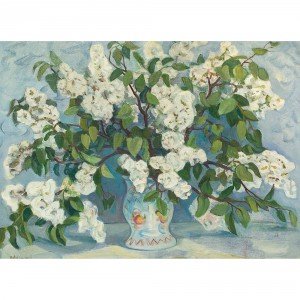

Larionov Vasiliy

White lilac

60 x 80 cm

3,215 € -

Unknown Artist

Mills in the Tauber Valley

28 x 38 cm

-

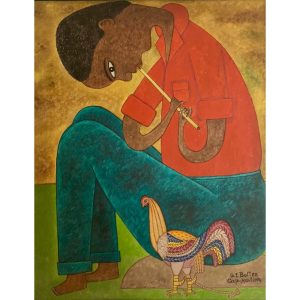

Bottex Seymour Etienne

Flutist

50 x 40 cm

3,550 € -

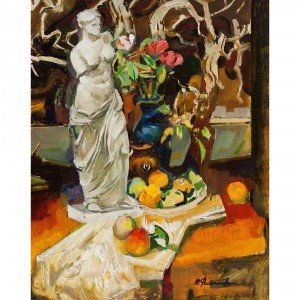

Filippov Yuriy

Still life with Venus

100 x 80 cm

6,150 € -

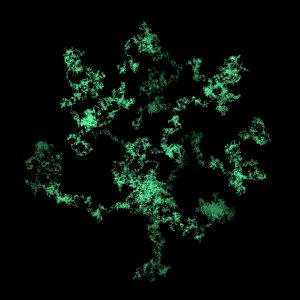

Slava Tishin

Horace’s Tree

100 x 100 cm

700 € -

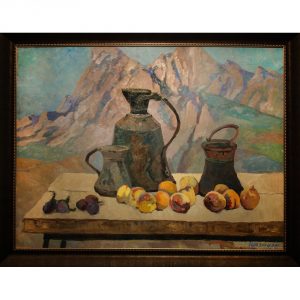

Shaginyan Mirel

Still life on a background of mountains

75 x 101 cm

-

Grigoreva-Klimova Olga

Boys on the beach

18 x 34 cm

1,000 €