The transnational circulation of works of art is a matter directly related to the national legislation applicable to these goods, to which we must add provisions and international treaties that may also apply on a case-by-case basis.

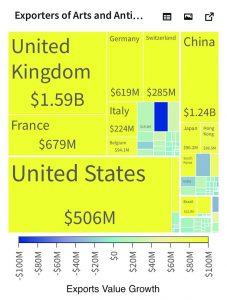

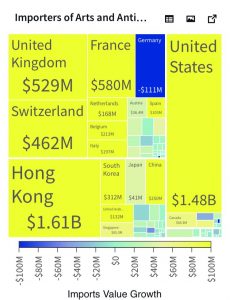

Curiously, the movement of paintings between the US and the UK in both directions has grown, which should probably be seen as a sign of the ongoing competition between the two world art capitals. Exports of works of art to Switzerland, which is a transit point for the art market, fell by only a quarter, while exports to other EU countries fell by more than 50 percent. The import of works of art from the territory of the European Union to the UK increased slightly – by 1.5 percent. The figures for the exchange of works of art between Great Britain and Hong Kong attract attention – judging by the statistics, this direction is actively developing.

Export value growth

«©️ Christie's Education ©️OEC»

2023

Imports value growth

«©️ Christie's Education ©️OEC»

2023

Value of global exports

«©️ Christie's Education ©️OEC»

2023

As each export situation is unique and customs regulations vary from country to country, I offer only general guidance.

EU

CUSTOMS OFFICE

While your export situation is always unique, it’s important to remember that customs authorities around the world generally treat art like any other commodity. So the aesthetic value is irrelevant. Rather, your artwork will be measured by accompanying paperwork, size, weight, and price. Export regulations differ depending on whether the work of art is being exported for commercial or private purposes.

Companies importing and exporting to countries outside the EU must submit an electronic export declaration to the customs administration.

CODE OF PRODUCT

For export to non-EU countries, commodity codes are used in accordance with the customs tariff, which can usually be found on the website of the country’s customs administration. It is important to use the correct item code for the type of art that is being

exported to avoid customs problems. Remember that you are responsible for correctly classifying your artwork, even if you use an agent to complete the export declaration form.

EORI number on the Customs website. Individuals can still manually apply for an EORI number when leaving the country, but applying early saves time. Individuals traveling with the intention of selling their art are subject to the same rules as companies and must therefore apply for an EORI number in advance.

TEMPORARY EXPORT WITHIN THE EU

Import and export barriers within the EU have been removed in favor of artists

Since the introduction of the single European market in EU member states, art can in principle be transported across EU borders without any customs restrictions. However, keep in mind that the powers of each. Member states still regulate imports.

TEMPORARY EXPORT OUTSIDE EU

Temporary export usually means that the goods must return to the country

origin for three years, as well as a restriction on processing or alteration during the export period. Individual als may receive a temporary export period extended up to ten years. If the artwork stays longer than this, the export will be considered final and subject to import VAT. However, in some countries, the import of art objects is not subject to duty. It is recommended that you contact the customs administration of the respective country to find out what rules apply to you.

The customs formalities involved in transporting works of art outside the European market are a time-consuming and costly bureaucracy.

Author's photo

«Exports and imports for art»

2023

Author's photo

«Exports and imports for art»

2023

Author's photo

«Exports and imports for art»

2023

Great Britain

Post-Brexit changes cover many areas: VAT on sales, VAT on imports and customs obligations, as well as changes in customs processes at UK borders. In the same way that the queue among incoming EU passports is a distant memory for most people traveling abroad, so is the joy of skipping “nothing to declare” when returning if you’re carrying art.

The UK and the EU have entered into a Trade and Cooperation Agreement which will enter into force on May 1, 2021. The main considerations for importers, exporters and international art owners after Brexit are as follows:

Sales VAT

Where goods are sold in the UK for export from the UK by the supplier within the appropriate timeframe (which is often three months, provided there is sufficient evidence of the date of export), the sale must be a zero VAT delivery on UK sales. Otherwise VAT on UK sales will apply as usual up to 20%. However, as before, some deliveries are subject to reduced or even zero rates.

In the past, knowledgeable overseas customers would have relied on VAT reduction schemes such as the Retail Export Scheme, now UK exports will be very different. If a buyer is visiting the UK and purchasing art for personal use, the zero rate no longer applies to the sale and VAT will be charged (and generally non-refundable) up to 20% even if they export the art. from UK promptly after purchase.

Import VAT and customs duty (“import duties”)

From 1 January 2021, works of art, collectibles and antiques imported into the UK mainland from EU countries are subject to VAT at a reduced rate of 5%. This applies whether it is imported privately or by VAT registered businesses and reflects the position on imports from the rest of the world. In order to qualify for the reduced 5% VAT rate on antiques, you may need to prove that your item in its current form was manufactured more than a hundred years before the date of importation by providing satisfactory documentary evidence.

Goods that are not antiques, works of art or collectibles are subject to the standard import VAT rate (currently 20%). Apart from import VAT, there are no tariff duties on works of art, collectibles and antiques when imported into the UK (or EU) regardless of their country of origin.

It is important to remember that the correct commodity codes must be used on the accompanying import documentation in order to benefit from the lower import VAT rate of 5% as well as duty-free importation.

If duties are payable, they are usually the responsibility of the importer. As a result, when goods cross the border, the importer has considerations:

The receiving jurisdiction(s) may impose import duties on certain goods based on their value, subject to exemptions and any applicable exemptions in that jurisdiction.

UK import duty exemptions have largely remained, such as temporary import exemptions and domestic processing exemptions. To apply these benefits, it is more important than ever to ensure that the conditions are met, the assistance required and the provision of monetary guarantees.

In Great Britain the system “Delayed accounting of the VAT” is entered. Businesses can report VAT on their VAT return, rather than paying it immediately upon importing goods into the UK.

UK sellers exporting art to the EU will be required to register for VAT in the respective Member State of sale.

International sellers importing art into the UK will likely need to register for UK VAT and will not be able to rely on previous registrations under EU margin schemes.

What is the score?

Businesses must obtain an Economic Operator Registration and Identification Number (EORI) starting with GB to commercially import and export goods from England, Wales and Scotland. The procedure in Northern Ireland may vary.

Exporters may require licenses to export certain goods depending on their type, classification, age and value. For example, there are several restrictions on the export of certain works of art from the UK.

It will be important to use a carrier that is well versed in delivering artwork and paying customs duties in accordance with regulations. Some of them may also act as “VAT Fiscal Representatives” and “Indirect Customs Representatives”, as required in some Member States.

USA

Works of art, collectibles, antiques and other cultural property applicable to imports In addition to the normal rules that apply to all types of imports, there are special rules that apply to certain types of cultural property in accordance with international agreements, treaties or requirements set forth in the Customs and Border Protection (CBP) Act and in the Harmonized Tariff Schedule. United States (HTSUS).The classification of goods according to HTSUS is carried out in accordance with the General Rules of Interpretation (GRI).

However, there is an item issued separately!

For example: original works of art such as paintings, drawings, pastels, collages and similar decorative plaques must be declared to the CBP, most of these items are eligible for duty-free entry into the United States under the provisions of heading 9701. To qualify for this heading, a painting, drawing or pastel (whether ancient or modern) must be done entirely by hand. However, hand-drawn plans and drawings for architectural, engineering, industrial, commercial, topographical or similar provisions do not fall in this heading but in heading 4906. Goods imported under heading 4906 are exempt from duty if they from the country of column 1, but subject to ad valorem duty of 25% for imports from the country of column 211 from the following countries: Russia, Cuba, Laos and North Korea. However, this list is subject to change. In addition, products from other countries may be subject to temporary trade sanctions or restrictions from time to time.

Hand-decorated articles such as wall coverings made of painted fabrics, holiday souvenirs, boxes, pottery (plates, dishes, vases, etc.) are usually classified under their own respective headings and are taxed at the rate of manufacture.

Original engravings, prints and lithographs (ancient or modern) are classified in subheading 9702.00.00. Thus, the original print may be marked “Dali, 1/75”. This will be the first of 75 prints created from the original plates (or stones). All 75 will be assigned to subheading 9702.00.0000. This classification applies whether engravings, prints or lithographs are framed or unframed. As in heading 9701, frames around original engravings, prints and lithographs are classified with these products, provided they are of the type and value customary for those products. Frames that are not of the type or value of ordinary products are classified separately and may be subject to different rates of duty.

Аntiques

Works of art, collectibles, antiques and other cultural property are classified under heading 9706 – the item must be over 100 years old at the time of entry. Under the age of 100 years, a 6.6% ad valorem duty is charged on items subject to the Common Regime (duty free for goods originating in Canada) or an ad valorem duty of 25% on items subject to the Common Regime.

For example, this heading includes antique furniture containing pieces of modern manufacture. However, if the underlying character has been altered or more than 50% of the item has been repaired or restored, the item is no longer considered an antique and is subject to duty.

SPECIAL RULES FOR PROTECTED CULTURAL PROPERTY

Pre-Columbian monumental or architectural sculptures or frescoes, stone monuments, altars, signposts, columns, monoliths, obelisks, statues, stelae, sarcophagi, thrones, zoomorphs, architectural structures, moldings or any other carving or decoration from the following countries: Belize, Bolivia, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Panama, Peru or Venezuela. Importation into the United States is required for any of the items listed above: A certificate issued by the government of the country of origin of such sculpture or mural, in a form acceptable to the Secretary of the Treasury, that such exportation does not violate the laws of that country; or satisfactory evidence that such sculpture or fresco was removed from the country of origin on or before June 1, 1973; or satisfactory evidence that such sculpture or fresco is not subject to the Pre-Columbian Monuments Act and Regulations.

In accordance with the Law on Cultural Property and regulations that may be implemented in accordance with a bilateral or multilateral agreement or in connection with emergency actions. Agreements with Member States establishing restrictions on the import of certain cultural property: Israel, Cyprus, Italy, Bolivia, Colombia, Cambodia, El Salvador, Peru, Mali, Venezuela, Nicaragua.

In addition, no object of cultural property which has been documented as part of the inventory of a museum, religious or secular public monument or similar institution in any State Party that has been stolen from such museum, monument or institution after 12 April 1983, or after the dates of entry into force of the UNESCO Convention for the State Party, whichever date occurs, can be imported into the United States as “archaeological or ethnological material” – protected cultural property, which equals additional bureaucratic and legal approvals upon importation!

Restrictions

For the import of works of art, sculpture, ceramics, painting, graphics, etc.

Cuba, Iraq, Iran, Sudan, Burma, Russia

Artwork, collectibles, antiques, and other cultural property may not be imported into the United States directly or through third countries without a license or prohibited from importing!

ISRAEL

As a rule, the import of art objects into Israel is not subject to customs duties. However, Value Added Tax (VAT) applies to all works of art. Original works of art imported by a museum or educational institution, or imported by a tourist, immigrant or returning resident are exempt from VAT but must be declared upon entry into Israel. VAT is applied to the auction house commission and if the purchase is an import, the import VAT is paid by the buyer. With regard to the commercial sale of second-hand works of art, VAT will only apply to the difference between the purchase price and the sale price, and not to the full sale price of the item.

The importation of personal effects by repatriates to Israel (or returning residents) can be facilitated without VAT, allowing the importation of private art collections into the country with certain restrictions (the collection must be from the importer’s family, the item cannot be sold). within six years of his arrival in Israel, etc.).

Cross-border transactions

Although there are no restrictions on the export of works of art, any export of antiquities from Israel is prohibited without the permission of the relevant authority!

The Archives Law also places restrictions on the export of archival material from Israel and requires proof that a government archivist has been given the opportunity to make a copy. Violation of this law is a criminal offense!

Israel is a party to one of the international conventions that impose restrictions on the illegal circulation of cultural property!

Will be happy to help with supporting documents and recommend a carrier that suits your needs.

Gala Matveeva-Finkilstein

Art historian, art advisor

Partner ART MOST

Studied:

A.N. Kosygina art critic

1st degree (bachelor)

HSE Media Communications

TAU (Tel Aviv University) art critic and art business 2-degree (master's degree)

Sotheby's Institute of Art MBA art business

Catalogue:

-

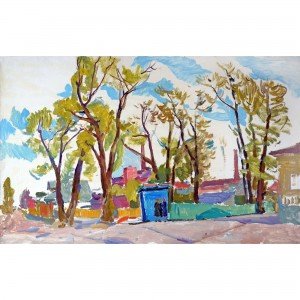

Firsov Aleksey

Coast of Crimea

26 x 48 cm

850 € -

Timofeev Viktor

Composition № infinity

60 x 83 cm

1,300 € -

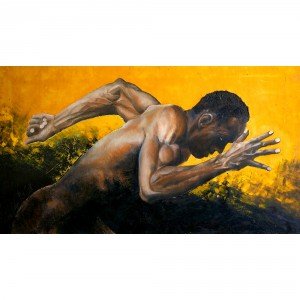

Stahl Natalia

Usain Bolt

50 x 75 cm

500 € -

Gorlanov Vladimir

Three girls

64 x 72 cm

4,250 € -

Otroshko Aleksandr

Vintage

124 x 163 cm

7,000 € -

Filippov Yuriy

Gossip

50 x 80 cm

5,000 € -

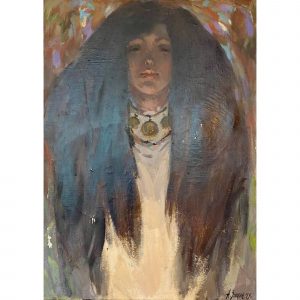

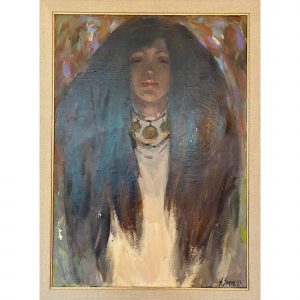

Zavarin Alexander

Night

70 x 50 cm

9,800 € -

Filippov Yuriy

Autumn is coming

53 x 78 cm

5,100 €